Your Personality Type and Your Relationship with Money

Over the last couple of weeks, I’ve spent some time researching the effects of personality type on money management. If you’ve ever wondered why money seems to slip through your fingers, or why you’re stressed about finances all the time, perhaps your personality type has a part to play! Today we’re going to look at the impact your type has on how you think and feel about finances. Let’s get started!

Not sure what your personality type is? Take our new questionnaire here!

Find out your child’s personality type here!

I link to one book in this article that is an affiliate link. This means that if you buy that book I get a small percentage to use towards keeping this site running.

Table of contents

- Your Myers-Briggs® Personality Type and Your Relationship with Money

- Judging and Perceiving – the Biggest Difference

- Personality Types and Money in More Detail:

- ESTJs and ESFJs

- ISFJs and ISTJs

- ESTPs and ESFPs

- ISTPs and ISFPs

- ENTJs and ENFJs

- INTJs and INFJs

- ENFPs and ENTPs

- INFPs and INTPs

- Intuition and Sensing – Specifics versus Big-Picture

- Thinking and Feeling

- Tips for Handling Financial Issues with Your Partner:

- What Are Your Thoughts?

Estimated reading time: 12 minutes

Your Myers-Briggs® Personality Type and Your Relationship with Money

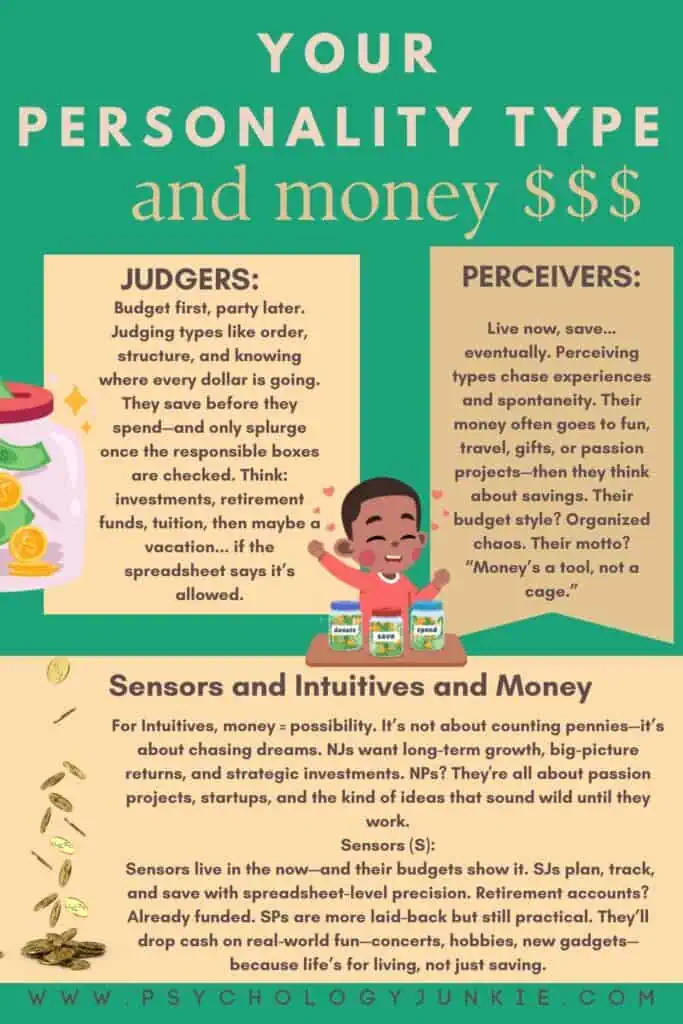

Judging and Perceiving – the Biggest Difference

Judgers and perceivers tend to look at money in fundamentally different ways. According to Otto Kroeger, past president of the Association of Psychological Type, and a current member of the National Training Laboratory Institute (NTL) of Applied Behavioral Sciences, Judgers tend to immediately save money, whereas Perceivers focus on spending.

“The Judgers’ list is always organized and neat and their responses are usually numbered and bulleted. Their list always reflects a conservative approach to money based on the premise that having money is the direct result of hard work and responsible living.”

Among the list of things that Judgers prioritized with their money were Investments, Budgets, Education, and Retirement. After all the “responsible” things were done with the money, they would look at spending it, but only after their security was taken care of.

Perceivers, in contrast, focused on spending the money before saving it.

“The rest of the (Perceivers’) list frequently isn’t a list at all but an apparent stream-of-consciousness outpouring that may be written anywhere on the sheet, by anyone in the group, in any of a variety of colors and styles. (Just looking at the sheet drives the Js crazy, as they identify this as typical of how Ps maintain their finances.)”

Among the list of things that Perceivers prioritized with their money were Fun, Vacations, Fulfilling a Dream, Buying Gifts, Giving to Someone who Needs It, and Enjoyment. After all the spending was done, then they would focus on savings and investments.

Obviously, there are always exceptions to these studies. There will always be the odd Judger who mixes up spending with saving, or the rare Perceiver who focuses on investments and retirement over enjoyment and fun.

You can find out more about Kroeger’s studies on personality type and finances in his book, 16 Ways to Love Your Lover: Understanding the 16 Personality Types So You Can Create a Love That Lasts Forever.

Which Method is Best?

There are good and negative things about both ways of managing money. Judgers tend to be more cautious and planned, taking care of more security-related matters. This can mean that they have more in their savings account in case of an emergency. However, they can become so fixated on saving and securing money that they lose sight of the joy it can provide! They can forget to use money to enrich their lives, and in worst-case scenarios, they can appear like Ebenezer Scrooge, counting all their money and storing it away while forgetting to see its value in being enjoyed and helping others.

Perceivers enjoy using money to amass thrilling experiences. They love the spontaneity they can enjoy with their money, but they may also wind up in a crisis when an emergency happens and they don’t have anything in their savings account. For these types, they may get so fixated on the short-term gains of spending money that they lose sight of the long-term security that comes from saving and investing.

Judgers and Perceivers both have something to learn from the other when it comes to matters of money management. Judgers can learn to enrich their life with the beautiful experiences money can provide. Perceivers can learn to set aside money carefully so that when emergency strikes, they aren’t left empty-handed.

Personality Types and Money in More Detail:

ESTJs and ESFJs

These types are some of the most structured when it comes to money. They like detailed, specific budgets and will balance them to the tee. Budgets? Nailed. Retirement plans? Already in motion. College savings? You better believe little Timmy’s future tuition is accruing interest right now.

When they feel secure, that’s when the fun kicks in—just not the kind of fun that involves irresponsibly buying crypto. We’re talking top-tier home appliances, ergonomic furniture, and maybe a Costco-sized membership to somewhere fancy. ESTJs lean into high-return investments and strategic risk. ESFJs? They’ll drop cash on gifts that make people cry happy tears, curated experiences, and the occasional designer outfit that says “I have my life together.”

ISFJs and ISTJs

These types are all about saving for a rainy day. Detailed and precise with their budgets, ISJs prioritize paying their bills and having their savings accounts well-padded. They’re the types attending Dave Ramsey seminars with highlighters and backup pens. According to the MBTI® Manual, ISTJs basically run the accounting world, and yeah, we believe it.

They crush bills, pay off debts early (just for fun), and keep emergency funds looking like mini trust accounts. When they finally treat themselves, it’s practical comfort all the way: sturdy furniture, familiar restaurants, and the one vacation spot they go back to every year because “why mess with perfection?”

ESTPs and ESFPs

Money is about experience and enjoyment for these two personality types. They want to live life to the fullest, and money is s a resource that they can use to make that possible. Spontaneous trips across the world, tickets to music festivals, or putting money down on bold business ventures adds excitement to their lives. They don’t mind taking some financial risks, especially if the reward seems within the realm of plausibility. Entrepreneurially-minded, they feel like playing it safe means missing out on some of the joy and thrill life has to offer. As these types get into mid-life they tend to prioritize saving more, but they will always try to make sure they have some “wiggle room” for spontaneous adventures and fun.

ISTPs and ISFPs

Money for these two is basically freedom tokens. They save, yes—but they also spend, because what’s the point of having money if you’re not gonna do something cool with it? These types like to keep an emergency fund just in case things go sideways… but if that “emergency” happens to be a once-in-a-lifetime trip or a vintage motorcycle, so be it.

ISTPs might invest in something low-key brilliant like solar tech or a vineyard. ISFPs will put money toward their passions, their home aesthetic, or helping a friend through a crisis. They don’t care much about status—but they do care about comfort, quality, and having stories to tell.

ENTJs and ENFJs

ENTJs and ENFJs think long-term, and they’re not here to mess around. Retirement planning? Check. Investments? Already diversified. But unlike their Sensing cousins, these two don’t fuss over every penny—they look at money like it’s potential energy waiting to explode into a legacy.

They’re the types who’ll put their cash into startups, scholarships, or stock portfolios that scream “future billionaire.” ENFJs might also funnel funds into passion projects or nonprofit dreams. Both types care less about hoarding wealth and more about using it to make an impact—whether that’s through business, education, or globe-hopping for inspiration.

INTJs and INFJs

INTJs and INFJs don’t just ask “how do I spend money?”—they ask “what does this spending say about my purpose in life?” These types are strategic savers, but not obsessed with dollar signs. INTJs want return on investment. INFJs want return on meaning.

You won’t find them blowing cash on whatever the influencer of the week is pushing. Instead, they’ll pour funds into higher education, travel with purpose, and hobbies that stretch the mind. Creative tools, spiritual retreats, maybe a language-learning app that costs more than it should—they’re in. Furniture? Meh. They’ll keep the same couch for a decade if it still has lumbar support.

ENFPs and ENTPs

Not afraid of risks, these types see money as a way to live life to the fullest and broaden their experiences and understanding. These two are less concerned with retirement plans and more concerned with how many places they can visit before 40. Or how many business ideas they can pitch before lunch.

Budgets are more of a vague suggestion than a strict rule. They’re not irresponsible—they just believe money is meant to move, not sit around in a dusty savings account. Over time, they might develop better financial habits, but they’ll always want some “mad money” to throw at the next big idea. Books, workshops, plane tickets, start-ups—they’re all fair game.

INFPs and INTPs

These two treat money like it’s a necessary evil—or a useful magic spell, depending on the day. INFPs and INTPs spend on what feeds their soul, not what pads their wallet. That might mean splurging on journals, gadgets, books, or hiking boots that’ll survive a zombie apocalypse.

They’re not reckless—they just don’t care about keeping up with anyone. Bills get paid (eventually), savings exist (in theory), and most purchases are weighed against how much joy or curiosity they’ll bring. Home comforts matter, but name brands and status symbols? Not really. They’d rather fund their next creative obsession than buy a sleek coffee table that no one’s allowed to touch.

Intuition and Sensing – Specifics versus Big-Picture

Here’s the deal: Intuitives treat money like a concept. An energy source. A gateway to possibility. They dream big, round numbers, and don’t always track every dollar—because they’re busy imagining how it could multiply. NJs want massive returns. NPs want to fund their passion projects and low-key revolutionize the world.

Sensors? They’re in the details. Especially the SJs. They track expenses like hawks, balance budgets down to the penny, and view money as a physical tool that solves real-world problems. SPs are a little looser, but still grounded—they’d rather spend on now than bank on someday. SJs are the retirement planners. SPs are the experience seekers.

According to a case-study, Sensing-Perceivers are the types least likely to plan for their retirement, while Extraverted-Judging types are the ones most likely to plan for retirement. Sensing-Perceivers are more likely to spend their money on experiences that enrich life, whereas Sensing-Judging types are more likely to save their money to build up a security net.

Thinking and Feeling

When it comes to finances, Thinking types see money as an opportunity to have power and success. They view it as a tool to maximize their abilities in life, and there’s nothing particularly personal about it.

Feelers, in contrast, may have a lot of guilt surrounding money. They often sense that it fosters greed, and they see it more personally. While they see financial success as a way to fulfill their dreams, they also worry about becoming too enraptured by it. Even so, there are no considerable differences that I could find in how these two preferences show up when it comes to money. Both like to use money to provide resources, help improve their station, and foster growth and development.

Tips for Handling Financial Issues with Your Partner:

When Your Partner is a Sensor…

- Appreciate your partner’s pragmatic attitude towards money.

- Pay attention to the specifics and details.

- Remember that when budgeting they will want specific numbers, not rounded numbers.

- Help them see future possibilities without being condescending about their point of view.

When Your Partner is an Intuitive…

- Let your partner know your specific financial needs.

- Give details that will help to inspire your partner’s big-picture ideas.

- Let them talk about how they would use the money to get a return in the future.

When Your Partner is a Thinking Type…

- Appreciate your partner’s objectivity about money.

- When there are financial disagreements, try not to personalize it.

When Your Partner is a Feeling Type…

- Be aware that you might view money differently. You might use money to gather resources, and he or she might buy gifts or sentimental objects or experiences. Don’t personalize or criticize.

- Stay calm during financial disagreements. Let them know about financial limits and details without imposing guilt.

When Your Partner is a Judger…

- Figure out early on how you will manage finances as a team. Decide on roles, responsibilities, goals, and how you’ll get there.

- Remember that your partner will become stressed when there is a poor plan or structure with money. Budgeting and having clear goals helps them feel secure.

- Explain why money should be saved, but why it should also be used to have some spontaneous fun and enrich life.

- Show appreciation for the financial security and structure they bring to the table.

When Your Partner is a Perceiver…

- Decide early on who will have the major roles regarding finances.

- If possible, set aside “play money” in your budget for spontaneous fun.

- Make focusing on your goals fun, and try not to get condescending when/if you see how money should be used differently.

- Show appreciation for the fun experiences and flexibility they bring to the table.

What Are Your Thoughts?

Do you notice any stark differences in how people of different types handle money? Let us know what you think in the comments!

Find out more about your personality type in our eBooks, Discovering You: Unlocking the Power of Personality Type, The INFJ – Understanding the Mystic, and The INFP – Understanding the Dreamer. You can also connect with me via Facebook, Instagram, or Twitter!

Other Articles You Might Enjoy:

Here’s What Job Satisfaction Means to You, Based on Your Personality Type

Why You Should Be an Entrepreneur, Based on Your Personality Type

The Career Nightmare of Every Personality Type

Here’s How You Procrastinate, Based on Your Personality Type

love your articles so detailed long and enjoyable and always on target . love learning of the mbti its so fun and entertaining. Thank you Ms. Storm!

Thanks so much Rachel!! I really appreciate this!

😨 The Perceivers’ list description is way too accurate. But I am working on that. Great article. ☺️

Hmm… I’m an INTP financial analyst and am all about budgeting, saving and investing.

My wife is an ESFJ and while not financially wreck less, can’t bring herself to budget. She’s much less focused on it than me.

For me, it’s not so much about planning or power as it is freedom. With financial independence, I can pursue the hobbies I enjoy and not be beholden to the man.

This makes sense for you in a way, as INTPs (like me) value freedom and independence, and for you money is a way to achieve this.

INTP here…I view money as a tool for living my life, but also that it should only be invested in worthwhile things that last or will have long-term benefits. So real, whole food, tools and appliances that assist with cooking from scratch, quality furniture, slow fashion. As a homemaker I have zero retirement savings or plans, but fortunately my SP husband is better with money than I am – although he has hobbies of his own that are expensive but add to his (and my) quality of life. I think I’m less of a spender than I used to be, as more things won’t give me more time to use them – unless they’re gadgets like a robot vac (ahem) that free up time to do other things.